How to calculate customer lifetime value? (SaaS CLV, LTV metrics)

So how exactly does lifetime value work? Let’s take a closer look!

Lifetime value is calculated as the total cost of goods sold (OCGO) less revenue achieved during the time frame in which the service was received.

The OCGO includes production expenses (e.g., advertising, marketing, shipping), inventory purchases, distribution fees, website development fees, etc. The OCGO also includes customer acquisition costs (CAC), including pre-sale promotions, advertisements, and/or free items for potential loyal customers to use as collateral for buying from you later.

By adding these up, we can calculate what it will cost you to get rid of your current supplier and switch to ours. This gives us our initial LTV calculation.

Here, we multiply OCGO by one plus CAC over the same time period to get our final number. Note that this number can easily be adjusted depending on whether you have additional products and if you plan to advertise more or less while using our services.

This seems straightforward. There are two main reasons why this formula seems wrong or needs clarification. How is lifetime value calculated?

First, some people may think that including CAC in the equation already accounts for the fact that you will no longer have access to those resources once they are spent.

The profitability of a business is a composite number that represents the profitability generated by the company over its lifetime. This can be calculated in many ways, depending on what you want to look at and how you wish to measure it.

Calculating the future lifetime value

Customer loyalty is a factor that is based on the customer’s lifetime value.

The average purchase frequency rate is a critical variable that defines the average lifetime value of an average customer.

Customer success represents the customer’s experience from entering your organization to leaving.

The subscription business model has been especially popular in the last few years, as companies have realized they could make money off their customers even if they did n’t sell anything. And while subscription services can feel like a gamble, what if your current subscribers sign up for another service you no longer offer? – it also allows companies to pull out all the stops with customer acquisition and retention efforts.

When brand loyalty is built, customers stay loyal for a long time. This gives the company higher profits and reduces the churn rate of its customer base.

The second part of calculating net profit is calculating your average customer lifespan or, more accurately, how long you expect an item to last. This is called the “expected lifespan” of the product!

Most companies use projected usage time frames or shelf lives to determine this. For example, if a company designs clothes that will always be in style, it can estimate how much clothing it will sell during its planned shelf life. They take this element away from depreciation, which happens when something loses quality, and people stop buying it.

This includes water damage due to poor waterproofing or materials breaking down and no longer working correctly. Most companies will deduct this amount from the cost of the item.

The difference between depreciation and lifespan is essential to understand. Depreciation is simply taking out the price of what was used to make the item less as you use it. In contrast, lifespan estimates how long someone would typically keep an object and applies that to the cost.

With clothing, design changes often render old products obsolete, so companies find other ways to market them. Many marketing departments will advertise that the material has been recycled or restyled to match current trends. This helps promote the brand’s image while at the same time allowing the environment to breathe.

These types of adjustments are taken into account when calculating the cost per unit of the item.

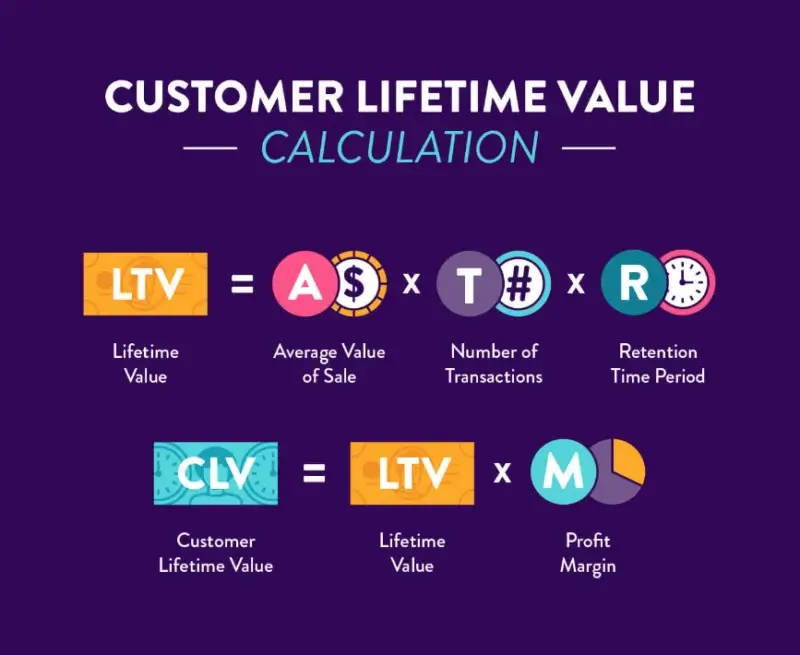

The customer lifetime value formula calculates customer value over the customers’ total lifecycle with your company. Customer lifetime value means valuable customers are acquired and retained at an acceptable price.

Calculating the present lifetime value

The final piece of calculating CLV is determining how to calculate your average life or period for this calculation. Most companies use an anniversary as your average life span, which makes sense since that is when most people sign up with their company!

However, some companies choose instead to use the term “retention period” for what we refer to as the average customer lifespan. This seems slightly more complicated at first glance, but it isn’t.

The difference in using one term vs. the other is just semantics. When you use the retention period, you are taking into account all of the times members have logged into their account, not just the initial joining.

By doing this, you better understand how long members use your product effectively. It also gives you an idea of how much time users invest in your service.

So why not use both? Using both an anniversary AND a retention period means incorporating both factors simultaneously into your calculations. Life is short, so why not maximize its length?

That said, here are the basics of each method!

Anniversary Method

The standard way to calculate LTV is by using an anniversary date. This happens, in general, when someone joins your organization or purchases a product from it.

To avoid confusion, differentiate between annual membership fees and extended membership dues. Only include the former in your LTV calculation because they will renew yearly anyway.

Determining how to increase a company’s lifetime value

The second way to determine if you should invest in marketing is to calculate the organization’s ‘lifetime value.’ Calculate how much each customer is likely to spend on a product or service after making one purchase and divide that number by the average number of customers.

This calculation assumes that customers will keep spending more and more every time they use your product or service. By adding up all these numerators and dividing them by the total enumerator, you get an overall measure of the lifetime value of your business.

If this number is high, it suggests that people are investing a lot in your products and services, which implies they are loyal to you and want to keep buying from you. This also means they expect excellent quality from you and hope to pay extra for what you provide.

Conversely, if this number is low, it may indicate that people need more funds, making it difficult for them to continue paying for your products and services. This could be due to poor performance, expensive competition, or both.

Ways to increase a company’s lifetime value

A way to determine how much a customer is worth to a business is by calculating their average purchase time. This can be done through discount codes, return policies, or asking if they would recommend your product to a friend.

By knowing what products a person has purchased in the past, we can calculate an individual’s average purchase time. By looking at this data, we can also determine how likely they will buy something else from you later.

This information is then plugged into the equation for determining lifetime value. The longer a potential buyer stays connected with your brand, the more you stand to gain!

Based on these numbers, there are three main ways to increase a company’s LV. Let’s look at each one in more depth.

Calculate your customer’s lifetime value

The final way to calculate CLV is by determining how much it would cost to replace one of your current customers with a new one.

This method assumes that if your business loses one of its members, it will only be replaced after some time. Considering this, we can determine how expensive a customer is by calculating how much you spend per year on them. This is called the average purchase amount (APA).

Calculate your customer lifetime value to determine your loyal customer value

The term’ lifetime value of a customer is typically used in two ways: 1) how much does this product or service cost, and 2) what are the average costs of repeat purchases?

The first way to use the term’ lifetime value’ has become very popularized. Many companies will add the word ‘value’ to their marketing material and advertising to emphasize the importance of figuring out how much their products/services truly cost per person.

This seems logical as most people recognize that buying something expensive can be wasteful if you only use it once. However, this emphasis may cause users to compare the LTV with the average purchase, which isn’t necessarily wrong. Still, it doesn’t take into account all of the different variables like whether someone wants to re-buy the item or not and if they already own a similar one then why not just get the newer model.

What is customer lifetime value?

The company’s total revenue over a period of time is divided by the total purchases made by its clients to determine the average purchase value.

So what is CLV, or customer lifetime value, exactly? It’s that elusive thing we discussed earlier: the amount of money you want to make from your business in the future.

CLV helps us calculate how much it will cost you to make that future sale. By figuring out how much each new customer costs you now (through direct expenses like marketing, sales staff, etc.) and then adding up all those costs for the whole group of customers. It is crucial to determine how much money each customer is worth to your business if you want to succeed.

The customer retention strategy is critical to the customer experience improvement program.

The revenue per user (ARPU) is calculated based on the total revenue generated by each customer during a specific period of time. RPU measures total revenue generated over a given period divided by the number of users in that same period who had positive net value to your business through their purchases, subscriptions, etc. The lifetime value should be considered as negative until you’ve determined how many customers will convert into paying subscribers and how long they are likely to stay with your service.

Clv may boost repeat customer retention and increase retention rates by improving customer support, goods, referrals, and loyalty programs. You may implement targeted measures surrounding pricing, sales, advertising, and customer retention to continually cut costs and increase revenue once you begin quantifying customer lifetime value and analyzing the individual components.

The math gets more complex than just taking the average revenue per user, but there are some helpful formulas and strategies for calculating this number.

The rate of the average number of times a client makes a purchase is determined by tallying up all of the purchases that a specific customer has made over a period of time.

Lifetime purchase frequency (LPF) is calculated using the total purchases made over time. A customer’s purchase frequency rate can be changed if they use multiple payment methods or alternate billing cycles. Changes in purchase frequency will result in changes to lifetime value calculations.

Good Tips

If your business is new and you don’t need more customers to compute an ACL, you can also get it from the rate of customers who leave. The first thing to note is whether or not your customer churn rate is high.

Analyze customer segments based on business metrics to identify your best customers and how much they are worth over their lifetime.

LTV reflects customer satisfaction and ultimately encompasses how effective your retention is.

Building brand loyalty is essential for any business because it increases the number of customers who stay with the company and the number of customers who leave going down.

Gross margin per lifespan (GML) is the profit you can expect to earn over the average lifespan of a single customer.

Email is the most popular channel for communication in today’s market. A personalized email can engage customers, build trust and improve brand loyalty. The email campaign should be personalized to each customer based on their profile data and needs. As an email marketing platform, it has all the necessary functionalities, tools & dashboards which make life easy for your marketers, like sending emails with attachments or images, etc…

Segmentation helps you understand who your customer is. You can make it based on different ways, such as demographics, behavioral data, or other dimensions, but it is time-consuming.

Why is customer lifetime value significant?

Customer lifetime value (CLV or CLTV) is a metric that shows how much money a business can expect to earn from a single customer account throughout that customer’s relationship with the business.

The life of a product comes down to its shelf life. If it goes out of style or people stop buying it, it will lose market share and, thus revenue.

If a business can’t make enough money from sales, it will have to cut back on spending in other areas, like marketing and keeping customers who are already loyal.

Understanding how much each customer is worth to a business can determine if a new sale is worth the investment. This information is called “customer lifetime value” (CLV).

A CLV calculation looks at two numbers: average purchase amount and retention time.

The average amount spent is calculated by dividing the total number of purchases by the time since the last purchase.

Retention time is measured in months and numbers of years. It’s the time between a person coming into contact with your product or service and then choosing to do something with it.

With both of these pieces of data, there is an easy way to calculate the CLV! Add up all the individual numbers and divide this total by 2.

That ratio is your CLV!

Why is this important? Because it tells you how much money a company would make per unit of time if they could capture more buyers who currently buy from them. A higher CLV means a higher income for your chosen product or category.

How is lifetime value calculated?

$

Money-back guarantee. Try it out to make sure it’s right for you!

Money-back guarantee. Try it out to be sure it’s the right fit for you! Or browse all available Lifetime deals.